Results 21 to 30 of 93

Hybrid View

-

09-22-2008, 01:23 AM #1

Senior Member

Senior Member

bailouts

Dream on. Come monday it will be business as usual. We just sucked into a one and half trillion dollar welfare program. Shit. I though repubs were against welfare? Originally Posted by Jerry Garcia 2007

killerweed420 Reviewed by killerweed420 on . bailouts know what pisses me off more is that both the dems, reps, and president are giving our money away to bad business ethic money waisting criminals. everyone thats scared of socialist b.s.. some of americas biggest firms are now socialized with the government taking the bill one of the worst thing about this is the ceo's and big wigs of the companies are goin to get their multi million dollar bonuses still. so they run companies into the ground with bad practices and still get their Rating: 5

Originally Posted by Jerry Garcia 2007

killerweed420 Reviewed by killerweed420 on . bailouts know what pisses me off more is that both the dems, reps, and president are giving our money away to bad business ethic money waisting criminals. everyone thats scared of socialist b.s.. some of americas biggest firms are now socialized with the government taking the bill one of the worst thing about this is the ceo's and big wigs of the companies are goin to get their multi million dollar bonuses still. so they run companies into the ground with bad practices and still get their Rating: 5

-

09-22-2008, 02:38 AM #2

Senior Member

Senior Member

bailouts

They are.. to be honest this was just a lose/lose situation. Sigh... I and I'm sure majority of other Americans are not happy. Originally Posted by killerweed420

Originally Posted by killerweed420

-

09-22-2008, 03:22 AM #3

Senior Member

Senior Member

bailouts

Breaking news:

Last major investment banks change status

By MARTIN CRUTSINGER, AP Economics Writer

11/21/2008

The Federal Reserve said Sunday it had granted a request by the country's last two major investment banks â?? Goldman Sachs and Morgan Stanley â?? to change their status to bank holding companies.

The Fed announced that it had approved the request of the two investment banks. The change in status will allow them to create commercial banks that will be able to take deposits, bolstering the resources of both institutions.

The change continued the biggest restructuring on Wall Street since the Great Depression.

The request for the change to bank holding companies was granted by a unanimous vote of the Fed's board of governors during a late Sunday meeting in Washington.

The change of status means both companies will come under the direct regulation of the Federal Reserve, which regulates the nation's bank holding companies. The banking subsidiaries of the two institutions will face the stricter regulations that commercial banks are required to meet.

Previously, the primary regulator for Goldman and Morgan Stanley was the Securities and Exchange Commission.

Shares of both institutions had come under pressure ever since the bankruptcy filing last week by investment bank Lehman Brothers and the forced sale of investment bank Merrill Lynch to Bank of America.

Investors feared that the last remaining independent investment banks would not be able to survive in their current form. There had been speculation that both institutions would be acquired by commercial banks, whose ability to take deposits would give them a stable source of funding.

The decision by the two giants of finance to get approval from the Fed to change their own status represented another dramatic development in one of the most turbulent periods in Wall Street history.

In the surprise announcement late Sunday, the central bank said that to provide increase funding support to the two institutions during the transition period, they would be allowed to get short-term loans from the Federal Reserve Bank of New York against various types of collateral.

The Fed said its action would take final effect after a five-day waiting period required under law.

The decision means that the Goldman and Morgan Stanley will be able not only to set up commercial bank subsidiaries to take deposits, giving them a major resource base, but they will also have the same access as other commercial banks to the Fed's emergency loan program.

After the collapse of Bear Stearns and its forced sale to JP Morgan Chase last March, the Fed used powers it had been granted during the Great Depression to extend its emergency loans to investment banks as well as commercial banks. However, that extension was granted on a temporary basis.

But as commercial banks, Goldman Sachs and Morgan Stanley will have permanent access to emergency loans from the Fed, the same privilege that other commercial banks enjoy.

The action by the Fed's board of governors in Washington came on a day when the Bush administration continued to campaign for quick congressional approval of its request for authority to use $700 billion to purchase a mountain of bad mortgage debt held by financial companies.

The effort represented the boldest action yet aimed at stabilizing chaotic financial markets.

Democrats in Congress said they would demand provisions in the bailout measure to protect people in danger of losing their homes as well as seeking to cap executive compensation at firms who get to unload their bad mortgages debt onto the government. But the proposal was expected to win quick congressional passage because both parties are concerned about the adverse reaction in financial markets should the measure look like it was being delayed.

Last major investment banks change status - Yahoo! News

-

09-22-2008, 04:57 AM #4

Senior Member

Senior Member

bailouts

hand in hand

they play merry go round!

all of a sudden parties are no more important, they come together... makes u wonder yet again why?!

I really do hope we are not gonna get screwed over like in the 30s... these politicians are all rich and there really will be nothing much they can do if we hit such a situation

-

09-22-2008, 05:39 AM #5

Senior Member

Senior Member

bailouts

Times will definitely be hard.. all of a sudden increasing corporate taxes doesn't seem so bad anymore.. I'll take the marginal unemployment increase over a market crash... Originally Posted by flyingimam

Originally Posted by flyingimam

sigh

I can't believe I honestly just said that.. rofl. It must truely be a bad situation for me to say that; but like all things, this too we'll make it through.

-

09-22-2008, 07:10 AM #6

Senior Member

Senior Member

bailouts

Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

Fellow citizens and taxpayers, this has got to be the last straw. Here we have a proposal to commit $700,000,000,000 of money we can ill afford, to bail out companies that not only made bad investments, but made those bad investments while paying their top executives obscene salaries. This is not bad enough, now the bush cabal wants to put Paulson in a position where he, and he alone has sole discretion in determining where and how this money will be doled out.

We have seen time and time again the total lack of regard these criminals have for the checks and balances our government was designed with. This however takes it to a new level. We're not talking about a small thing here folks, this is almost a trillion dollars with absolutely no oversight on a man (Paulson) who as the CEO of Goldman Sachs from 1999 to 2006, most certainly played a part in the creation of financial crisis.

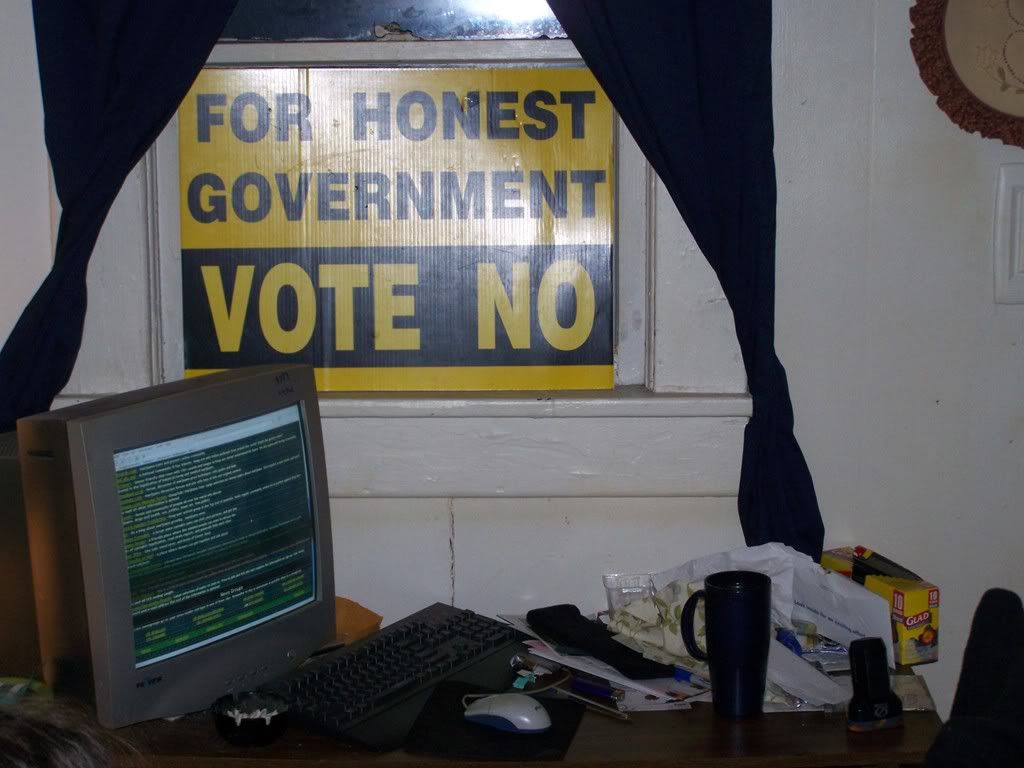

Just Like the sign says that has been in the front window of my house for the last two years.....

And,Yes That is My Desk!!!!

-

09-22-2008, 07:16 AM #7

Senior Member

Senior Member

bailouts

could u please provide the source of this, citations will help to verify if this is actually what is in the proposal. i know dems have so far put up a fight to make sure there is independent oversight and taxpayer protection, but if this is whats being sent to congress to be voted on... i must say its just such a shame... Originally Posted by The Figment

Originally Posted by The Figment

lol how old is that CRT... i got a similar crappy box! keep it for a few more years and we may get paid more than what we paid for them antiques & collectibles of the digital era!

antiques & collectibles of the digital era!

-

09-22-2008, 10:06 AM #8

Senior Member

Senior Member

bailouts

I know im citing a far left source, however this article IF holding true should be read by any and all citizens of this land who give a rats arse about their very near future affairs!

RSS: US: Welcome to the Final Stages of the Coup

dont be bashin me, i said IF it hold true... gotta get some details on the damn bailout plan with our money, seems to be classified for now

-

09-22-2008, 12:55 PM #9

Senior Member

Senior Member

bailouts

Its too late... times are already hard, and the ones that are getting hit first and hardest are the retirees on fixed incomes, and small businesses....especially in the rural areas. Originally Posted by daihashi

Originally Posted by daihashi

-

09-22-2008, 01:47 PM #10

Senior Member

Senior Member

bailouts

In the spirit of Live Aid, and Farm Aid, I'm really surprised that with their overblown sense of importance...that Hollywood hasn't organized a Financial-Aid' concert to help cure the financial ills of the world. Would fit in nicely with their 'green' philosophy, lol.

Advertisements

Similar Threads

-

Fox News: Bailouts 101

By Markass in forum PoliticsReplies: 3Last Post: 09-25-2008, 06:18 PM

Register To Reply

Register To Reply

Staff Online

Staff Online